World Economic Forum: a history and analysis

Topics

World Economic Forum/Flickr/CC BY-NC-SA 2.0

This article and its accompanying infographic have been jointly published by the Transnational Institute and Occupy.com.

The annual meetings of the World Economic Forum (WEF) in Davos, Switzerland, bring together thousands of the world’s top corporate executives, bankers and financiers with leading heads of state, finance and trade ministers, central bankers and policymakers from dozens of the world’s largest economies; the heads of all major international organizations including the IMF, World Bank, World Trade Organization, Bank for International Settlements, UN, OECD and others, as well as hundreds of academics, economists, political scientists, journalists, cultural elites and occasional celebrities.

The WEF states that it is “committed to improving the state of the world through public-private cooperation,” collaborating with corporate, political, academic and other influential groups and sectors “to shape global, regional and industry agendas” and to “define challenges, solutions and actions.” Apart from the annual forum meeting in Davos, the WEF hosts regional and sometimes even country-specific meetings multiple times a year in Asia, Latin America, Africa and elsewhere.

The Forum is host to dozens of different projects bringing together academics with corporate representatives and policy-makers to promote particular issues and positions on a wide array of subjects, from investment to the environment, employment, technology and inequality. From these projects and others, the Forum publishes dozens of reports annually, identifying key issues of importance, risks, opportunities, investments and reforms.

The WEF has survived by adapting to the times. Following the surge of so-called anti-globalization protests in 1999, the Forum began to invite non-governmental organizations representing constituencies that were more frequently found in the streets protesting against meetings of the WTO, IMF and Group of Seven. In the 2000 meeting at Davos, the Forum invited leaders from 15 NGOs to debate the heads of the WTO and the President of Mexico on the subject of globalization.

The participation of NGOs and non-profit organizations has increased over time, and not without reason. According to a poll conducted on behalf of the WEF just prior to the 2011 meeting, while global trust in bankers, governments and business was significantly low, NGOs had the highest rate of trust among the public.

In an interview with the Wall Street Journal last September, the founder and executive chairman of the WEF, Klaus Schwab, was asked about the prospects of “youth frustration over high levels of underemployment and unemployment” as expressed in the Arab Spring and Occupy Wall Street movements, noting that the Forum was frequently criticized for promoting policies and ideologies that contribute to those very problems. Schwab replied that the Forum tries “to have everybody in the boat.”

Davos, he explained, “is about heads of state and big corporations, but it’s also civil society – so all of the heads of the major NGOs are at the table in Davos.” In reaction to the Occupy Wall Street movement, Schwab said, “We also try... to put more emphasis on integrating the youth into what we are doing.”

WEF's beginnings

So, what exactly has the World Economic Forum been doing, and how did it emerge in the first place? It began in 1971 as the European Management Forum, inviting roughly 400 of Europe’s top CEOs to promote American forms of business management. Created by Klaus Schwab, a Swiss national who studied in the U.S. and who still heads the event today, the Forum changed its name in 1987 to the World Economic Forum after growing into an annual get together of global elites who promoted and profited off of the expansion of "global markets." It is the gathering place for the titans of corporate and financial power.

Despite the globalizing economy, politics at the Forum have remained surprisingly national. The annual meetings are a means to promote social connections between key global power players and national leaders along with the plutocratic class of corporate and financial oligarchs. The WEF has been a consistent forum for advanced “networking” and deal-making between companies, occasional geopolitical announcements and agreements, and for the promotion of "global governance" in a world governed of global markets. Indeed, the World Economic Forum’s main purpose is to function as a socializing institution for the emerging global elite, globalization’s "Mafiocracy" of bankers, industrialists, oligarchs, technocrats and politicians. They promote common ideas, and serve common interests: their own.

Writing in the Financial Times, Gideon Rachman noted that more than anything else, “the true significance of the World Economic Forum lies in the realm of ideas and ideology,” noting that it was where the world’s leaders gathered “to set aside their differences and to speak a common language... they restate their commitment to a single, global economy and to the capitalist values that underpin it.” This reflected the “globalization consensus” which was embraced not simply by the powerful Group of Seven nations, but by many of the prominent emerging markets such as China, Russia, India and Brazil.

Indeed, the World Economic Forum’s main purpose is to function as a socializing institution for the emerging global elite, globalization’s "Mafiocracy" of bankers, industrialists, oligarchs, technocrats and politicians. They promote common ideas, and serve common interests: their own.

Geopolitics and Global Governance

The World Economic Forum has been shaped by – and has in turn, shaped – the course and changes in geopolitics, or "world order," over the past several decades. Created amidst the rise of West Germany and Japan as prominent economic powers competing with the United States, the oil shocks of the 1970s also produced immense new powers for the Arab oil dictatorships and the large global banks that recycled that oil money, loaning it to Third World countries.

New forums for "global governance" began to emerge, such as the meetings of the Group of Seven: the heads of state, finance ministers and central bank governors of the seven leading industrial powers including the U.S., West Germany, Japan, UK, France, Italy and Canada, starting in 1975. When the debt crisis of the 1980s hit, the International Monetary Fund and the World Bank achieved immense new powers over entire economies and regions, reshaping the structure of societies to promote “market economies” and advance the interests of domestic and international corporate and financial oligarchs.

Between 1989 and 1991, the global power structure changed dramatically with the fall of the Berlin Wall and the collapse of the Soviet Union. With that came President George H.W. Bush’s announcement of a "New World Order" in which America claimed "victory" in the Cold War, and a unipolar world took shape under the hegemony of the United States. The ideological war between the West and the Soviet Union was declared victorious in favor of Western Capitalist Democracy. The "market system" was to become globalized as never before, especially under the presidency of Bill Clinton who led the U.S. during its largest ever economic expansion between 1993 and 2001.

During this time, the annual meetings of the World Economic Forum became more important than ever, and the role of the WEF in establishing a "Davos Class" became widely acknowledged. At the 1990 meeting, the focus was on Eastern Europe and the Soviet Union’s transition to “market-oriented economies.” Political leaders from Eastern Europe and Western Europe met in private meetings, with West German Chancellor Helmut Kohl articulating his desire to reunify Germany and cement Germany’s growing power within the European Community and NATO.

Helmut Kohl laid out his strategy for shaping the “security and economic structure of Europe” within a unified Germany. Kohl’s “grand design” for Europe envisioned a unified Germany as being “firmly anchored” in the expanding European Community, the main objective of which was to establish an "internal market" by 1992 and to advance toward an economic and monetary union, with potential to expand eastward. Kohl presented this as a peaceful way for German power to grow while assuaging fears of Eastern Europeans and others about the economically resurgent country at the heart of Europe.

At the 1992 WEF meeting, the United States and reunified Germany encouraged “drastic steps to insure a liberalization of world trade,” and furthered efforts to support the growth of market economies in Eastern Europe. The German Economics Minister called for the Group of Seven to meet and restart global trade talks through the 105-nation General Agreement on Tariffs and Trade (GATT). At that same meeting, the Chinese delegation included Prime Minister Li Peng, who was the highest-level Chinese official to travel internationally since the 1989 Tiananmen Square crackdown.

Of great significance also was the attendance of Nelson Mandela, the new president of South Africa. When Mandela was released from prison in 1990, he declared the policy of the African National Congress (ANC) was to implement “the nationalization of the mines, banks and monopoly industries.” When Mandela attended the January 1992 meeting of the WEF just after becoming president, he changed his views and embraced “capitalism and globalization.”

Mandela attended the meeting alongside the governor of the central bank of South Africa, Tito Mboweni, who explained that Mandela arrived with a speech written by ANC officials focusing on nationalization. As the week’s meetings continued, Mandela met with leaders from Communist Parties in China and Vietnam, who told him, “We are currently striving to privatize state enterprises and invite private enterprise into our economies. We are Communist Party governments, and you are a leader of a national liberation movement. Why are you talking about nationalization?”

As a result, Mandela changed his views, telling the Davos crowd that he would open South Africa up as a market economy and encourage investment. South Africa subsequently became the continent’s fastest growing economy, though inequality today is greater than it was during apartheid. As Mandela explained to his official biographer, he came home from the 1992 WEF meeting and told other top officials that they had to choose: “We either keep nationalization and get no investment, or we modify our own attitude and get investment.”

At the 1993 meeting, the main consensus that had emerged called for the U.S. to maintain its position as a global economic and military power, and for it to take the lead encouraging greater “co-operation” between powerful nations. The major fear among Davos participants was that while economies were becoming globalized, politics was turning inward and becoming “renationalized.”

Later that year, Anthony Lake, Bill Clinton’s National Security Adviser, articulated the “Clinton Doctrine” for the world, explaining: “The successor to a doctrine of containment must be a strategy of enlargement – enlargement of the world’s free community of market democracies.” Lake explained that the United States “must combine our broad goals of fostering democracy and markets with our more traditional geostrategic interests.” No doubt, the Davos crowd welcomed such news.

At the 1994 meeting, the director-general of GATT, Peter D. Sutherland, declared that world leaders needed to establish “a new high-level forum for international economic co-operation,” moving beyond the Group of Seven to become more inclusive of the major "emerging market" economies. Sutherland told the assembled plutocrats that “we cannot continue with the majority of the world’s people excluded from participation in global economic management.” Eventually, the organization Sutherland described was formed, as the Group of 20, bringing the leading 20 industrial and economic powers together in one setting. Formed in 1999, the G20 didn't become a major forum for global governance until the 2008 financial crisis.

In 1995, the Financial Times noted that the new “buzzword” for international policymakers was “global governance,” articulating a desire and strategy for updating and expanding the institutions and efforts of international co-operation. The January 1995 World Economic Forum meeting was the venue for the presentation of an official UN report on global governance. President Clinton addressed the Davos crowd by satellite, stressing that he would continue to push for the construction of a new “economic architecture,” notably at meetings of the Group of Seven.

The arrival of the Davos Class

[The Davos Men] “have little need for national loyalty, view national boundaries as obstacles that are thankfully vanishing, and see national governments as residues from the past whose only useful function is to facilitate the elite’s global operations." (Samuel Huntington)

In 1997, the highly influential U.S. political scientist Samuel Huntington coined the term "Davos Man," which he described as a group of elite individuals who “have little need for national loyalty, view national boundaries as obstacles that are thankfully vanishing, and see national governments as residues from the past whose only useful function is to facilitate the elite’s global operations.”

Samuel Huntington's thesis, summarized in the Financial Times article, outlined a world that “would be divided into spheres of influence,” within which “one or two core states would rule the roost.” Huntington noted that the “Davos culture people,” while extremely powerful, were only a tiny fraction of the world’s population, and the leaders of this faction “do not necessarily have a secure grip on power in their own societies.”

The Financial Times, however, noted that while the "Davos culture people" did not constitute a “universal civilization” being such a tiny minority of the world’s population, “they could be the vanguard of one.”

An article that year in The Economist came to the defense of the "Davos Man," declaring that he was replacing traditional diplomacy which was “more likely to bring peoples together than to force them apart,” noting that the WEF was “paid for by companies and run in their interests.”

TNI fellow, Susan George in her book, Whose Crisis, whose future, went further than Huntington arguing that we were not just facing a group of elites, but a genuine social class who "run our major institutions, know exactly what they want, and are well organized." But she also noted that "they have weaknesses too. For they are wedded to an ideology that isn't working and they have virtually no ideas nor imagination to resolve this."

Russian Oligarchs and the Rise of China

In fact, at the previous year’s meeting in Davos, the World Economic Forum functioned precisely as the vanguard for seven Russian oligarchs to take control of Russia and shape its future. At the 1996 meeting of the WEF, the Russian delegation was made up largely of the country’s new oligarchs who had amassed great fortunes in the transition to a market economy. Their great worry was that Russian President Boris Yeltsin would lose his re-election later that year to the resurgence of the Communists.

At the WEF meeting, seven Russian oligarchs, led by Boris Berezovsky, formed an alliance during private meetings, where they decided to fund Yeltsin’s re-election and work together to “reshape their country’s future.” This alliance (or cartel, as some may refer to it), was the key to Yeltsin’s re-election victory later that year, as they held weekly meetings with Yeltsin’s chief of staff, Anatoly Chubais, the architect of Russia’s privatization program that made them all so rich.

Berezovsky explained that if the oligarchs did not work together to promote common ends, it would be impossible to have a transition to a market economy “automatically.” Instead, he explained, “We need to use all our power to realize this transformation.” As the Financial Times noted, the oligarchs “assembled a remarkable political machine to entrench and promote the market economy – as well as their own financial interests,” as the seven men collectively controlled roughly half the entire Russian economy.

Russian politician Anatoly Chubais commented on this development and the role of the oligarchs, saying: “They steal and steal and steal. They are stealing absolutely everything and it is impossible to stop them... But let them steal and take their property. They will then become owners and decent administrators of this property.”

In the 1990s, with the spread of global markets came the spread of major financial crises: in Mexico, across Africa, East Asia, Russia and then back to Latin America. At the WEF meeting in 1999, the key issue was “reform of the international financial system.” As the economic crises spread, the Group of Seven nations, and the Davos Class, told the countries in crisis that in order “to restore confidence [of the markets], they should adopt politically unpopular policies of radical structural reform,” promoting further liberalization and deregulation of markets to open themselves up to Western corporate and financial interests and 'investment.'

The major emerging markets have been frequent participants in annual Davos meetings, providing a forum in which national elites may become acquainted with the global ruling class, with whom they then cooperate and do business. China started sending more high-level delegations to the WEF in the mid-1980s. During the 2009 meeting, two prominent speakers were President Putin of Russia and the Chinese Prime Minister Wen Jiabao. Both leaders painted a picture of the crisis as emanating from the centers of finance and globalization in the United States and elsewhere, with the “blind pursuit of profit” and “the failure of financial supervision” – in Wen’s words – and bringing about what Putin described as a “perfect storm.” Both Wen and Putin, however, declared their intentions to work with the major industrial powers “on solving common economic problems.”

In 2010, China’s presence at Davos was a significant one. Prime Minister Wen Jiabao, who attended the previous year, was not to return. In his stead, his chosen successor, Li Keqiang, attended. China’s economy was performing better than expected as its government was coming under increased pressure from major global corporations.

Kristin Forbes, a former member of the White House Council of Economic Advisers and an attendee at Davos, commented, “China is the West’s greatest hope and greatest fear... No one was quite ready for how fast China has emerged... Now everyone is trying to understand what sort of China they will be dealing with.” China sent its largest delegation to date to the World Economic Forum, with a total of 54 executives and government officials, many of whom were intending to “go shopping” for clients among the world’s elite.

Li Keqiang, the future Chinese prime minister, told the Davos audience that China was going to shift from its previous focus on exports and turn to “boosting domestic demand,” which would “not only drive growth in China but also provide greater markets for the world.” Li explained that China would “allow the market to play a primary role in the allocation of resources.”

In 2011, The New York Times declared that the World Economic Forum represented “the emergence of an international economic elite” that took place at the same time as unprecedented increases in inequality between the rich and poor, particularly in the powerful countries but also in the fast-emerging economies. Chrystia Freeland wrote that “the rise of government-connected plutocrats is not just a phenomenon in places like Russia, India and China,” but that the major Western bailouts reflected what the former chief economist at the IMF, Simon Johnson, referred to as a “quiet coup” by bankers in the United States and elsewhere. Davos and the Financial Oligarchy

The power of global finance – and in particular, banks and oligarchs – has grown with each successive financial crisis. As the financial crisis tore through the world in 2008, the January 2009 meeting of the World Economic Forum featured less of the Wall Street titans and more top politicians. Klaus Schwab declared, “The pendulum has swung and power has moved back to governments,” adding that “this is the biggest economic crisis since Davos began.” Goldman Sachs, which in past years was “renowned for hosting one of the hottest parties at the World Economic Forum’s glittering annual meeting in Davos,” had cancelled its 2009 party. Nonetheless, Jamie Dimon, CEO of JPMorgan Chase, decided to continue with his plans to host a Davos party.

Goldman Sachs.. was “renowned for hosting one of the hottest parties at the World Economic Forum’s glittering annual meeting in Davos" In 2010, thousands of delegates assembled to discuss the "important’ issues of the day. And despite the reputation of banks and bankers being at all-time lows, top executives of the world’s largest financial institutions showed up in full force. The week before the meeting, President Obama called for the establishment of laws to deal with the "too big to fail" banks, and European leaders were responding to the anger of their domestic populations for having to pay for the massive bailouts of financial institutions during the financial crisis. Britain and France were discussing the prospect of taxing banker bonuses, and Mervyn King, then governor of the Bank of England, suggested the possibility of breaking up the big banks. Several panels at the WEF meeting were devoted to discussing the financial system and its possible regulation, as bankers like Josef Ackermann of Deutsche Bank suggested that they would agree to limited regulations (at least on "capital requirements").

More important, however, were plans for a series of private meetings of government representatives and bank chiefs, who would meet separately, and then together, in Davos. Roughly 235 bankers were to attend the summit – a 23% increase from the previous year. Global bankers and other corporate leaders were worried, and warned the major governments in attendance against the financial repercussions of pursuing “a populist crackdown” against banks and financial markets. French President Nicolas Sarkozy spoke to the Forum’s guests about a need for a “revolution” in global financial regulation, and for “reform of the international monetary system.” The heads of roughly 30 of the world’s largest banks held a private meeting at Davos “to plot how to reassert their influence with regulators and governments,” noted a report on Bloomberg. The “private meeting” was a precursor to a later meeting at Davos involving top policymakers and regulators.

Brian Moynihan, CEO of Bank of America, said of the assembled bankers, “We’re trying to figure out ways that we can be more engaged.” According to Moynihan, a good deal of the closed-door discussion “was about tactics, such as who the executives should approach and when.” The CEO of UBS, a major Swiss bank, commented that “it was a positive meeting, we’re in consensus.”

The bankers said they were aware that some new rules were inevitable, but they wanted to encourage regulators and countries to coordinate the rules through the Group of 20, revived in 2009 as the premier forum for international cooperation and "global governance."

Josef Ackermann, CEO of Deutsche Bank, suggested that “we should stop the bank bashing,” and affirmed that banks had a “noble role” to play in managing the economic recovery. Christine Lagarde, France's Finance Minister and current Managing Director of the IMF, encouraged a “dialogue” between governments and banks, saying, “That’s the only way we’re going to get out of it.” Later that week, the bankers met “behind closed doors with finance ministers, central bankers and regulators from major economies.”

The key message at the time from finance ministers, regulators and central bankers was a political one: “They [the banks] should accept more stringent regulation, or face more draconian curbs from politicians responding to an angry public.” Guillermo Ortiz, who had just left his post as governor of the central bank of Mexico, said, “I think banks have misjudged the deep feelings of the public regarding the devastating effects of the crisis.” French President Sarkozy stated that “there is indecent behavior that will no longer be tolerated by public opinion in any country of the world,” and that bankers giving themselves excessive bonuses as they were “destroying jobs and wealth” was “morally indefensible.”

As the 2011 Davos meeting began, Edelman, a major communications consultancy, released a report that revealed a poll conducted among 5,000 wealthy and educated individuals in 23 countries, considered to be “well-informed.” The results of the poll showed there to be a massive decline in trust for major institutions, with banks taking the biggest hit. Prior to the financial crisis in 2007, 71% of those polled expressed trust in banks compared with a new low of 25 percent in 2011.

A home for a global elite

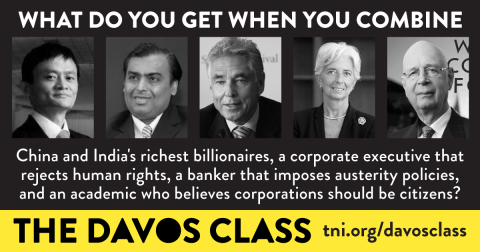

Despite the lack of public trust in banks and financial institutions, Davos remains devoted to protecting and expanding the interests of the financial elite. In fact, the Foundation Board of the World Economic Forum (its top governing body) includes many representatives of the world of finance and global financial governance.

Among them, (as this infographic makes clear) are Mukesh Ambani, who sits on advisory boards to Citigroup, Bank of America and the National Bank of Kuwait; and Herman Gref, the CEO of Sberbank, a large Russian bank. Ernesto Zedillo, the former President of Mexico who is also a member of the board, currently serves as a director on the boards of Rolls Royce and JPMorgan Chase, international advisory boards to BP and Credit Suisse, an adviser to the Bill & Melinda Gates Foundation, and is a member of the Group of Thirty and the Trilateral Commission as well as sitting on the board of one of the world's most influential economic think tanks, the Peterson Institute for International Economics.

Also notable, Mark Carney, the governor of the Bank of England, is a member of the Foundation Board of the World Economic Forum. Carney started his career working for Goldman Sachs for 13 years, after which he was appointed as Deputy Governor of the Bank of Canada. After a subsequent stint in Canada’s Ministry of Finance, Carney returned to the Bank of Canada as governor from 2008 to 2013, when he became the first non-Briton to be appointed as head of the Bank of England in its 330-year history. From 2011 to present, Carney has also been the Chairman of the Financial Stability Board, run out of the Bank for International Settlements in Basel, Switzerland.

Apart from heading the FSB, Mark Carney is also a board member of the BIS, which serves as the central bank for the world’s major central banks. He is also a member of the Group of Thirty, a private and highly influential think tank and lobby group that brings together dozens of the most influential economists, central bankers, commercial bankers and finance ministers. Carney has also been a regular attendee at annual meetings of the Bilderberg Group, an even more-exclusive "invite only" global conference than the WEF.

Though there are few women among the WEF’s membership – let alone its leadership – Christine Lagarde has made the list, while simultaneously serving as the managing director of the IMF. She previously served as the French finance minister throughout the course of the financial crisis. Lagarde also attends occasional Bilderberg meetings, and is one of the most powerful technocrats in the world. Min Zhu, the deputy managing director of the IMF, also sits on the WEF’s board.

Further, the World Economic Forum has another governing body, the International Business Council, first established in 2002 and composed of 100 “highly respected and influential chief executives from all industries,” which “acts as an advisory body providing intellectual stewardship to the World Economic Forum and makes active contributions to the Annual Meeting agenda.”

The membership of the WEF is divided into three categories: Regional Partners, Industry Partner Groups, and the most esteemed, the Strategic Partners. Membership fees paid by corporations and industry groups finance the Forum and its activities and provide the member company with extra access to meet delegates, hold private meetings and set the agenda. In 2015, the cost of an annual Strategic Partner status with the WEF had increased to nearly $700,000. Among the WEF’s current strategic partners are Bank of America, Barclays, BlackRock, BP, Chevron, Citi, Coca-Cola, Credit Suisse, Deutsche Bank, Dow Chemical, Facebook, GE, Goldman Sachs, Google, HSBC, JPMorgan Chase, Morgan Stanley, PepsiCo, Siemens, Total, and UBS, among others.

Depending on its finances from these sources, as well as being governed by individuals from these and others institutions, it is no surprise that Davos promotes the interests of financial and corporate power above all else. This is further evident on matters related to trade.

Davos and "Trade"

Trade has been another consistent, major issue at Davos meetings – which is to say, the promotion of powerful corporate and financial interests has been central to the functions of the WEF. As the Wall Street Journal noted, “it is pretty much a tradition that trade ministers meet at Davos with an informal meeting.”

At the 2013 meeting, U.S. Trade Representative Ron Kirk explained at Davos that the Obama administration was “committed to reaching an agreement to smooth trade with the European Union,” saying in an interview that “we greatly value the trans-Atlantic relationship.” The week’s meetings suggested that there “were signs of progress toward a trade accord.” Thomas J. Donohue, the president of the U.S. Chamber of Commerce, who was present at Davos, commented that “half a dozen senior leaders in Europe are ready to move forward.” In fact, at the previous Davos meeting in January 2012, high level U.S. and EU officials met behind closed doors with the Transatlantic Business Dialogue (TABD), a major corporate grouping that promotes a U.S.-E.U. “free trade” agreement. The TABD was represented at the meeting by 21 top corporate executives, and was attended by U.S. Trade Representative Kirk, WTO Director-General Pascal Lamy, the European Commissioner for Trade, Karel De Gucht, other top technocrats, and Obama’s Deputy National Security Adviser for International Economic Affairs, Michael Froman (who is now the U.S. Trade Representative). The result of the meeting was the release of a report on a "Vision for the Future of EU-US Economic Relations," which called “to press for urgent action on a visionary and ambitious agenda.”

The meeting also recommended the establishment of a "CEO Task Force" to work directly with the "High Level Working Group" of trade ministers and technocrats to chart a way forward.

Just prior to the 2013 meeting in Davos, the TABD corporate group merged with another corporate network to form the Transatlantic Business Council (TBC), a group of top CEOs and chairmen of major corporations, representing roughly 70 major corporations. The purpose of the TBC was to hold “semi-annual meetings with U.S. Cabinet Secretaries and European Commissioners (in Davos and elsewhere).” At the Davos 2013 meeting, the TBC met behind closed doors with high level officials from the U.S. and EU. Michael Froman, who would replace Ron Kirk as the U.S. Trade Rep, spoke at the meeting, declaring that “the transatlantic economy is to become the global benchmark for standards in a globalized world.”

The following month, the U.S. and EU "High Level Working Group" released its final report in which it recommended “a comprehensive trade and investment agreement” between the two regions. Two days after the publication of this report, President Obama issued a joint statement with European Council President Herman Van Rompuy and European Commission President José Manuel Barroso, in which they announced that “the United States and the European Union will each initiate the internal procedures necessary to launch negotiations on a Transatlantic Trade and Investment Partnership,” or TTIP.

At the announcement, Kirk declared the sectors that will fall under the proposed agreement, stating that, “for us, everything is on the table, across all sectors, including the agricultural sector.”

The World Economic Forum in a World of Unrest

Perhaps most interestingly, the World Economic Forum has been consistently interested in the prospects of social unrest, protests and resistance movements, particularly those that directly confront the interests of corporate and financial power. This became particularly true following the mass protests in 1999 against the World Trade Organization, which disrupted the major trade talks taking place in Seattle and marked the ascendency of what Davos called the “anti-globalization movement.”

These issues were foremost on the minds of the Davos Class as they met less than two months later in Switzerland for the annual WEF meeting in 2000. The New York Times noted that as President Clinton attempted to address the issue of restoring “confidence in trade and globalization” at the WEF, global leaders – particularly those assembled at Davos – were increasingly aware of the new reality that “popular impressions of globalization seem to have shifted” with growing numbers of people, including the protesters in Seattle, voicing criticism of the growing inequality between rich and poor, environmental degradation and financial instability.

The head of the WTO declared that “globalism is the new ‘ism’ that everyone loves to hate... There is nothing that our critics will not blame on globalization and, yes, it is hurting us.”

The guests included President Clinton, British Prime Minister Tony Blair and Mexican President Ernesto Zedillo, along with the leaders of South Africa, Indonesia, Malaysia and Finland, among others. The head of the WTO and many of the world’s trade ministers were also set to attend, hoping to try to re-start negotiations, though protesters were also declaring their intention to disrupt the Forum’s meeting. With these worries in mind, the Swiss Army was deployed to protect the 2,000 members of the Davos Class from being confronted by protesters.

As the World Economic Forum met again in January of 2001 in Davos, “unprecedented security measures” were taken to prevent “hooligans” from disrupting the meeting. On the other side of the world, in Porto Alegre, Brazil, roughly 10,000 activists were expected to converge for the newly-formed World Social Forum, a counter-forum to Davos that represented the interests of activist groups and the Third World. As the Davos Class met quietly behind closed doors, comforted by the concrete blocks and razor wire that surrounded the small town, police on the other side of the fence beat back protesters.

In the wake of the financial crisis, the WEF meeting in 2009 drew hundreds of protesters to Davos and Geneva where they were met by riot police using tear gas and water cannons. Inside the Forum meeting, French Finance Minister Christine Lagarde warned the assembled leaders, “We’re facing two major risks: one is social unrest and the second is protectionism.” She noted that the task before the Davos Class was “to restore confidence in the systems and confidence at large.” Protesters assembled outside held signs reading, “You are the Crisis.”

The January 2012 WEF meeting took place following a year of tumultuous and violent upheavals across the Arab world, large anti-austerity movements across much of Europe, notably with the Indignados in Spain, and the Occupy Wall Street movement just months prior in the United States and across much of the world. As the meeting approached, the WEF announced in a report that the top two risks facing business leaders and policy makers were “severe income disparity and chronic fiscal imbalances.” The report warned that if these issues were not addressed it could result in a “dystopian future for much of humanity.” The Occupy Movement had taken the issue of inequality directly to Davos, and there was even a small Occupy protest camp constructed at Davos. As the Financial Times noted, “Until this year [2012] the issue of inequality never appeared on the risk list at all, let alone topped it.” At the heart of it was “the question of social stability,” with many Davos attendees wondering “where else unrest might appear.” Beth Brooke, the global vice chair of Ernst & Young, noted that “countries which have disappearing middle classes face risks – history shows that.”

With citizens taking to city streets and protesting in public squares from Cairo to Athens and New York, the Financial Times noted that discontent was “rampant,” and that “the only consistent messages seem to be that leaders around the world are failing to deliver on their citizens’ expectations and that Facebook and Twitter allows crowds to coalesce in an instant to let them know it.” For the 40 government leaders assembling in Davos, “this is not a comforting picture.”

In Europe, democratically elected leaders in Italy and Greece had been removed and replaced with economists and central bankers in a technocratic coup only months earlier, largely at the behest of Germany. Mario Draghi, the head of the European Central Bank (ECB), was perhaps “the most powerful leader in Europe,” though an Occupy movement had sprung up at the headquarters of the ECB in Frankfurt as well. During the Forum, Occupy protesters outside clashed with police. Stephen Roach, a member of the faculty at Yale University and a chairman of Morgan Stanley Asia, wrote an article in the Financial Times describing his experiences as a panelist at the "Open Forum," held on the last day of the Davos gathering, in which citizens from the local community could participate along with students and Occupy protesters.

The topic he discussed was “remodeling capitalism,” which, Roach wrote, “was a chance to open up this debate to the seething masses.” But the results were “disturbing” as “chaos erupted immediately” with chants from Occupy protesters denouncing the forum and calling for more to join them. Roach wrote that it was “unruly and unsettling” and he “started thinking more about an escape route than opening comments.”

Once the discussions began, Roach found himself listening to the first panelist, a 24-year-old Occupy protester named Maria who expressed anger at “the system” and that there was a “need to construct a new one based on equality, dignity and respect.” Other panelists from the WEF included Ed Miliband from the UK, a UN Commissioner, a Czech academic and a minister from the Jordanian dictatorship. Roach noted that compared to Maria from Occupy, “the rest of us on the panel spoke a different language.”

Having spent decades as a banker on Wall Street, Roach confessed that “it as unsettling to engage a hostile crowd whose main complaint is rooted in Occupy Wall Street,” explaining that he attempted to focus on his expertise as an economist, “speaking over hisses.” He explained that all of his "expert" insights on economics “hardly moved this crowd.” Maria from Occupy, Roach wrote, got the last word as she stated, “The aim of Occupy is to think for yourself. We don’t focus on solutions. We want to change the process of finding solutions.” As “the crowd roared its approval,” Roach “made a hasty exit through a secret door in the kitchen and out into the night.” Davos, he wrote, “will never again be the same for me. There can be no retreat in the battle for big ideas.”

In October of 2013, The Economist reported that “from anti-austerity movements to middle-class revolts, in rich countries and in poor, social unrest has been on the rise around the world.” A World Economic Forum report from November 2013 warned of the dangers of a “lost generation” that would “be more prone to populist politics,” and that “we will see an escalation in social unrest.” Over the course of 2013, major financial institutions such as JPMorgan Chase, UBS, HSBC, AXA and others were issuing reports warning of the dangers of social unrest and rebellion. JPMorgan Chase, in its May 2013 report, stated that Europe’s “adjustment” to its new economic order was only “halfway done on average,” warning of major challenges ahead. The report complained about laws hindering the advancement of its agenda, such as “constitutional protection of labor rights... and the right to protest if unwelcome changes are made to the political status quo.”

The 2014 meeting of the World Economic Forum drew more than 40 heads of state, including then-president of Ukraine, Viktor Yanukovich, as well as Mexico’s Enrique Pena Nieto, Japanese Prime Minister Shinzo Abe, British Prime Minister David Cameron, Brazilian Presient Dilma Rousseff, Iranian President Hassan Rouhani, Israeli Prime Minister Benjamin Netanyahu and Nigeria’s Goodluck Jonathan. U.S. Treasury Secretary Jacob Lew and prominent central bankers such as Mario Draghi and Mark Carney also attended alongside IMF Managing Director Christine Lagarde and World Bank president Jim Yong Kim.

As the meeting began, a major report by the World Economic Forum was published, declaring that the “single biggest risk to the world in 2014” was the widening “gap between rich and poor.” Thus, income inequality and “social unrest are the issue[s] most likely to have a big impact on the world economy in the next decade.” The report warned that the world was witnessing the “lost generation” of youth around the world who lack jobs and opportunities, which “could easily boil over into social upheaval,” citing recent examples in Brazil and Thailand.

Brazilian President Dilma Rousseff is due to attend the annual Davos meeting this week. But just prior to that meeting, violent protests erupted in the streets of Brazil in opposition to austerity measures imposed by President Rousseff, recalling “the beginnings of the mass street demonstrations that rocked Brazil in June 2013.” One wonders whether Rousseff will be attending next year’s meeting of the WEF, or whether she will still even be president.

Indeed, the growth and power of the Davos Class has grown with – and spurred – the development of global unrest, protests, resistance movements and revolution. As Davos welcomes the global plutocrats to 2015, no doubt they'll be reminded of the repercussions of the "market system" as populations around the world remind their leaders of the power of people.